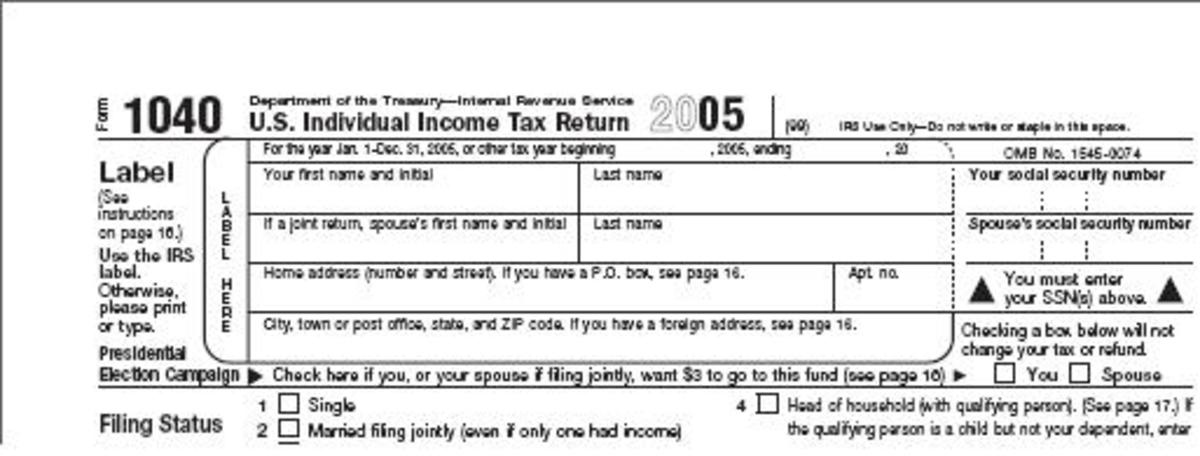

How Tax Cuts Work

Making Work Worth While

According to October 11, 2006 news reports, the Federal deficit (the amount by which government spending exceeds tax and other government revenues) has shrunk to its lowest amount in four years.

In addition to being good news, it also showed that the tax cuts implemented by the Bush administration are working.

The tax cuts are working in that they are generating more revenue than before they were cut.

Why does cutting taxes result in MORE tax money being collected? The short answer is that by reducing tax rates (the percent of tax collected on each dollar of income) the government encourages people to work and earn more.

Library of Congress WW II Photo

Just as a business will often opt to reduce the price of its goods in order to increase the amount sold, the government is basically reducing the cost of working and thereby encouraging people to work and earn more.

While it takes less in taxes on each dollar taxpayers earn, it collects the smaller amount from a much larger base of income thereby raking in a larger amount of tax dollars from a larger volume of taxable income.

The longer explanation has to do with the progressive nature of our tax system.

Our Federal income tax has a series of rates rather than one rate. Basically, what the government does is set a schedule of tax brackets, say $1 -$20,000 worth of income is taxed at 10%; 20,001 - $30,000 at 20%; and $30,001 and above at 50%.

In this scenario , everyone, from the poorest to the richest taxpayer pays 10% of the first $20,000 worth of income. A wealthy person earning $100,000 per year pays 10% of the first $20,000 she earns while the high school student with a part-time job earning $10,000 pays 10% of his income.

While the high school student just pays his $1,000 in taxes (10% of $10,000); the wealthy person also has to pay 20% or $2,000 on the income earned between $20,001 and $30,000 and another $35,000 in taxes on the income between $30,001 and $100,000 (50% of the remaining $70,000 of income).

By reducing the top bracket rates, the government provides more incentive to work (prior to Ronald Regan, the top rate in the U.S. was about 90%, while in England the top rate at that time was something like 101% which resulted in the taxes on the income in the last bracket being more than the amount earned).

Once a person earns enough to pay their basic living expenses (food, clothing and shelter) they can afford to choose between work and leisure. The higher the marginal tax rates (the taxes on the marginal or last amount of income earned) the less incentive one has to work.

The idea behind the high rates is that the high marginal rates apply only to rich people who can afford the taxes because it does not deprive them of the money needed for life's basic needs.

This is true, However, since they have already earned enough in the lower brackets to pay for their basic needs, they now have a choice between working all day and having the government tax most of the recent income away or quit work for the rest of the year and play golf.

When people stop working, they stop stop producing (meaning there are fewer goods being produced for the rest of us to buy) but they are also not making any money that the government can tax. If the tax on income in excess of, say $30,000 is 90% and people stop working as soon as their income for the year reaches $29,999 then the government gets to collect taxes at the rate of 90% of nothing.

Most of us can't stop working when our income reaches a certain figure. However, higher income people are often professionals who have some control over the hours they work.

Thus, people like doctors, lawyers, stockbrokers, etc. can usually control their hours and cut back as their income rises.

The Multiplier Effect Resulting From Ronald Reagan's Decision to Make 5 Rather than Movies Per Year

Former President Regan himself experienced this while he was an actor. As a star actor he was in a position to accept or reject a script. He calculated that making five pictures per year put his income just below the highest bracket. So, if he did a sixth picture, most of the income would go to Uncle Sam. As a result he limited himself to 5 pictures per year and spent more time with his family.

With other actors doing the same, the public had fewer shows to watch. However, this did not stop with star actors working less and the public making do with fewer new movies. With fewer shows being made, there was less work for lower paid actors who were below the star level as well as all the other behind the scenes people who help to make a movie.

Not only did the government lose taxes on the extra money that the star actors would have made if they had not voluntarily left the workforce but it also lost the taxes the larger group of lower paid actors and other workers would have made if they had not been laid off involuntarily due to lack of work.

While people making lower incomes usually cannot temporarily stop working on their regular job in order to avoid being pushed into a high rate tax bracket, they can keep their income down by turning down extra work.

The factory worker who accepts less overtime because additional overtime will throw him into a higher tax bracket. The person working a part-time job in addition to their full time job who quits the part-time job because most of it goes to taxes.

Finally, the working spouse. In many cases one spouse, due to education and experience, will have a considerably higher income than the other spouse. With high marginal taxes, couples in this situation will find that the income from the lower income spouse is not worth the effort because most of it goes to taxes.

How is this so? Well, for most households income taxes are calculated on the combined incomes of the husband and wife. Let's assume a 90% tax on incomes in excess of $40,000 and assume that the husband earns $39,999 and the wife earns $20,000.

With a 90% tax the $20,000 being brought in by the wife works out to an additional income for the household of $2,000 because $18,000 of her income is taxed away. Unless the husband is able to cut his hours and reduce his income by $20,000 to keep the household income at $39,999 it does not make sense for the wife to continue working.

By reducing high marginal tax rates more people have the incentive or opportunity to work and more people have the incentive to work longer hours and this not only generates more goods and services but a much larger income base on which to levy taxes.

So, why do deficits increase every time the government cuts taxes? While reductions in tax rates begin immediately, which causes a temporary drop in government revenues, the adjustment process takes a while as people slowly realize that their paychecks are suddenly larger and could be even larger if they worked more.

Along with this realization process, there is also a lag between people deciding to work more and actually finding that work.

The other, more important, reason why deficits initially balloon when taxes are cut is that Congress not only refuses to cut spending but continues increasing spending.

Library of Congress Depression Era Photo of New Mexico Farmer and Wife Working on Income Taxes

The Politics of Tax Cuts

As promised in my comment above, I will try to elaborate on the points which livelonger and Ralph Deeds have raised.Both livelonger and Ralph Deeds expressed concern about the deficits that follow tax cuts.

As I explained above, cutting taxes does temporarily reduce government revenues and this will result in a deficit. However, the large deficits that accompanied both the Regan and Bush tax cuts were the result of Congress insisting on charging ahead with increased spending. As former U.S. Treasury Secretary Paul O'Neill once observed,

"There is a constituency in the Congress that sees the tax code as a way to do favors for people which is a way to get elected that's not as obvious as actually writing them a check from the American people”.*

This is the sad truth about modern politics. Members of Congress get elected by lining up single issue special interest groups who deliver their group's block of votes in exchange for the local Congressman or Senator providing funds for their favorite projects. Without the votes of these special interest groups few members of Congress would survive more than one or two terms in office. As of this writing (October 21, 2006) the country is upset with the job being done by Congress and, as the majority party in both houses, the Republican party stands a good chance of losing one or both houses in the upcoming elections. However, don't be surprised if the Republicans retain control of both houses, because, as a few observers have pointed out, the American people are fed up with Congress as a whole but many give high marks to their local representative and senator. Leaders of both parties acknowledge this fact when they give the expected optimistic reply that they expect a major victory in November and then immediately qualify that with former House Speaker Sam Rayburn's reminder “that all politics is local”. This quote about all politics being local is what you will be hearing from the losing party in November as they try to explain away this year's defeat.

So, what about the deficit? In financial terms, a deficit is nothing more than current spending exceeding current income. Individuals, households and governments run deficits all the time as their income on any particular day or week (or month or quarter in the case of the government) comes in periodic lumps rather than a smooth daily flow. A couple of days ago, I purchased gas and a few groceries using a credit card (temporary debt) for one and cash left over from my last pay check (drawing down savings) for the other. Since I received no income that day, my household was in deficit. Yesterday, I purchased lunch and my wife filled her car with gas. I also received my pay for the past two weeks so our income for the day was much greater than our expenses leaving a large surplus in our checking account. In the coming days I will draw down the surplus (which by then will be considered past savings) in our checking account to pay the credit cards thereby clearing up the short term debt that was used to finance the deficits of the past two weeks. In this sense the only difference between the U.S. Treasury and my management of our household finances is magnitude – the U.S. Treasury both receives and spends much greater sums than our household, but the process is the same. If short term deficits cannot be offset with short term surpluses, then both households and governments have to clear such deficits with longer term debt. This is where we run the risk, in the case of government, of saddling future generations with today's deficits. Households are limited in the amount they can borrow by the quality of their credit scores and their income. Households can only handle so much debt then they have to stop spending.

But governments are different. Their income comes from taxes which taxpayers have to pay or else. However, tax cuts are popular and, when people come to realize that taxes can go down as well as up, they become resistant to tax increases. This means that Congress, just like ordinary household faces a ceiling beyond which they cannot continue spending because they no longer have access to the tax hikes needed to sustain the spending. This is why deficits have suddenly become very important to the political elites. Congress needs money to spend on projects favored by special interests in order to guarantee re-election. However, if they have to raise the money by increasing taxes they risk angering a larger group of voters and this could also cost them the election.

The dispute here is not over whether cutting high marginal tax rates encourages people to work and earn more or whether deficits are good or bad. Paul Krugman himself acknowledges that my description of how tax cuts work is correct when he states in the third paragraph of the third section of his article entitled The Tax-Cut Con (which Ralph Deeds kindly provided), that:

Remove all of the rhetoric and, angry charges and half truths levied by both sides in the debate and what you have left is the real point of contention which is whether we should have more government or whether we should have less government. This is an argument about politics, not economics. Economics is just a tool used by politicians to achieve a political end. The tool is neutral and can be used by either side. President Kennedy introduced a tax cut when he came into office in 1960 and the Republicans promptly opposed it for both political and economic reasons.

Politically active economists on the left, like Krugman and the late John Kenneth Galbraith, while agreeing with the economic theory behind the tax cuts, have opposed them for the simple political reason that most voters like the idea of paying less taxes and having more money for themselves. However, lower taxes mean smaller government and the smaller the federal government the less able it is to pay for the schemes advanced by special interest groups. Krugman makes it very clear in his article that he doesn't want the federal government to be shrunk to pre-New Deal levels. Galbraith also made it very clear the he favored big government and high taxes and went so far as to imply, in The Affluent Society and other books, that the government, not the citizens who worked and earned the income, should be the one to determine how the wealth of the nation should be spent.

Krugman, in the third from the last paragraph in his article entitled The Tax-Cut Con, states the choice very clearly when he states:

Reply to Ralph Deed's Questions in Comment Number 13

The first question in Comment 13 was “Do you agree that tax cuts for the middle class and low income groups are more stimulative than those for the rich as in the case of Bush's cuts?”

The answer to this depends upon what one means by “stimulative”.

As I explained in the new Hub that I just published, “Democratic vs Republican Tax Cuts”, the Keynesian style tax cuts favored by Democrats are designed to stimulate demand by getting people to spend money and buy more, while the supply side tax cuts favored by Republicans are designed to stimulate work and investment to produce more.

From a strictly economic point of view, the answer depends upon whether you want to stimulate demand or supply. Going a step further, the only reason one would want to stimulate demand would be if the economy was in a downturn with high unemployment AND policy makers did not want to have prices or wages fall (as was the case in the 1930s when laws supported business cartels and union wage agreements that did not allow for downward adjustment of prices and wages).

In this case, a Keynesian style tax cut would stimulate demand. However, Keynesian style tax cuts are inflationary and deliberately lead to deficits, so I don't see how such a cut would do any good for today's economy given our low rate of unemployment.

Now, if you are proposing a tax cut in the lower brackets along with corresponding simultaneous cuts in spending (so that it will not be inflationary or cause the deficit to rise) I would be all for it since I am a middle class taxpayer and my household would benefit from such a tax cut.

As to your comment about tax cut for the oil industry this is a stretch, as I believe that you are referring to the attempt earlier in 2006 by Democrats in Congress to impose a special tax on oil company profits (a so called “windfall profits” tax). I really don't see how failure to enact a special tax on one group of citizens constitutes a tax cut.

Using this logic, the Democrats in Congress could be accused of increasing the estate tax. Since President Bush proposed that this tax be eliminated and the Democrats in Congress have prevented this from being enacted then, using your logic, they are guilty of increasing the estate tax.

Social Security & Medicare Taxes

As to Social Security and Medicare, these programs are nothing more than a tax on working people to fund a welfare program for retired people.

This is not something that I or some other conservative dreamed up. It is a summation of the arguments presented to the Supreme Court in the 1937 case of Helvering vs Davis and the 1960 case of Flemming vs Nestor.

In the first case Guy T. Helvering, Commissioner of the Internal Revenue Service under President Roosevelt successfully argued that the Social Security Act was not an unconstitutional expansion of power by the Federal Government into the area insurance and pensions, but was the simple exercise of the Federal Government's right under the Constitution to levy taxes and promote the general welfare.

During oral arguments in this case, Chief Justice Charles Evans Hughes made comments to the effect that what the government was saying was that Congress could repeal the tax or the welfare portion, or both, at any time.

Supreme Court Case of Flemming vs Nestor

In the 1960 case of Flemming vs Nestor, President Eisenhower's Secretary of Health Education and Welfare, Arthur Flemming, successfully argued that Congress had the right to change the Social Security Act in any way they wished, as this was nothing more than a tax program and a general welfare program that happened to be linked. If you go to the Social Security Administration's website (www.ssa.gov/history/nestor.html) you will see that it sums up the Nestor case as follows:

“The fact that workers contribute to the Social Security program's funding through a dedicated payroll tax establishes a unique connection between those tax payments and future benefits. More so than general federal income taxes can be said to establish "rights" to certain government services. This is often expressed in the idea that Social Security benefits are "an earned right."

This is true enough in a moral and political sense. But like all federal entitlement programs, Congress can change the rules regarding eligibility--and it has done so many times over the years. The rules can be made more generous, or they can be made more restrictive. Benefits which are granted at one time can be withdrawn, as for example with student benefits, which were substantially scaled-back in the 1983 Amendments.

There has been a temptation throughout the program's history for some people to suppose that their FICA payroll taxes entitle them to a benefit in a legal, contractual sense. That is to say, if a person makes FICA contributions over a number of years, Congress cannot, according to this reasoning, change the rules in such a way that deprives a contributor of a promised future benefit. Under this reasoning, benefits under Social Security could probably only be increased, never decreased, if the Act could be amended at all.

Congress clearly had no such limitation in mind when crafting the law. Section 1104 of the 1935 Act, entitled "RESERVATION OF POWER," specifically said: "The right to alter, amend, or repeal any provision of this Act is hereby reserved to the Congress."

Even so, some have thought that this reservation was in some way unconstitutional. This is the issue finally settled by Flemming v. Nestor.”

What Social Security has done is tax workers to support retirees. Until tax sheltered IRA and 401(k) type accounts came into existence, the Social Security tax and the income tax, made it very difficult for people to save for retirement. This left retirees largely dependent upon the government for their financial survival.

The Social Security Administration, in the two paragraphs above, makes it very clear that a Social Security “pension” is no different than any other Federal entitlement program which can be changed at will by Congress. The only thing unique about Social Security is that those who have paid into the program should be able to expect to receive benefits upon retirement, but only “in a moral and political sense”.

There is no legal right to Social Security benefits regardless of how long and how much one has contributed. People who purchased Enron stock had more legal rights than those who contribute to Social Security every payday. Just as Nobel Laureate Frederich Hayek warned in his 1944 book, The Road to Serfdom, programs like this are leading us backwards toward serfdom, rather than forward.

Neither Social Security nor Medicare are structured in a way that would provide either program with any type of solvency other than faith that Congress will appropriate sufficient funds for them each year.

There is no Social Security trust fund (the so called trust fund consists of a special class of bonds that are purchased only by the Treasury Department – these bonds are similar to a person stuffing money into their mattress each week to save for retirement, but then pulling money out as needed for other things and replacing it with IOUs (you can imagine what their retirement will be like) and there are no Medicare reserves. The whole system is based upon trusting Congress to live up to their “moral and political” obligation to keep funding the program.

But what happens if the ratio of supporters to opponents shifts and opponents outnumber supporters – will morality or politics guide Congress in deciding which group to please and which to anger? Even if Congress does take the high road, it would only take a couple of elections to change the balance of power in Congress.

The sensible thing to do is to start dismantling the system now by first making provision to continue support for those already retired and those who are about to retire. Give those who are within ten to fifteen, or even twenty years of retirement age give the choice of a cash buyout based upon the contributions to their accounts (employer and employee plus interest) or staying in the program and receiving benefits based upon today's existing law.

However, invest the Social Security contributions of this group into annuities, so that the taxpayers will only have to make up the difference between the annuity payments and today's benefit levels. For everyone else, abolish both the tax and the welfare portions of the program. Except for those close to retirement who elect to stay in the program and pay the Social Security taxes there would be no more Social Security or Medicare taxes and support for those already retired would be paid out of general tax revenues.

Actually, the breaking point may come sooner rather than later. While waiting for my son to finish work the other day, I happened to see a copy of the October 23, 2006 issue of The Financial Times which had an article in the top left corner of the front page which described how the independent Financial Accounting Standards Advisory Board (FASAB) is considering an accounting rule that would require the Federal Government to account for the liabilities accrued for future entitlements in the Social Security, Medicare and other entitlement programs.

Just as private corporations now must do with their future pension liabilities, the government would have to acknowledge on a yearly basis just how much it will need to pay for future entitlement claims and set money aside to meet these claims.

The government, of course, is opposing this accounting rule change as it would force them, on an annual basis, to explain to the citizens who are being forced to pay into these programs, just how they plan to guarantee the promised benefits.

On the one hand it will strengthen the promise to older workers that the money will be there to pay them. On the other hand, it will also provide an annual reminder to the younger workers just what these escalating future liabilities will require them to pay for with rising taxes.

With tax sheltered IRA and 401(k) type accounts offering these younger workers a much better payout at a lower cost, we may see demands for abolition of the system by younger workers sooner, rather than later.

We have already seen corporations, when forced by similar rules to face these potential liabilities in their owned defined benefit pension plans, quickly shift away from such plans by providing newer workers with defined payment plans (401(k) type plans) which the individual workers own and the employer is only responsible for their promised annual contributions during the worker's term of employment.

The U.S. Government is under no obligation to accept the new FASAB rule even if the rule is passed by the board, as FASAB merely sets standards for the accounting profession.

However, after all the political grandstanding over corruption in private corporations and the passage of laws requiring private corporations to follow FASAB guidelines in their accounting, it would be difficult for the government to announce that it was not going to follow FASAB rules in its own accounting.

Foreign governments are also very concerned about this rule being passed and the U.S. Government following it, least their citizens demand the same type of accountability from them. Now might be a good time to re-read Hans Christian Anderson's tale about “The Emperor's New Suit”, but substitute “the Welfare State” for the “Emperor” and “FASAB” for the little child.

Library of Congress photo from 1940s Promoting Social Security.