Social Security's Achilles Heel

The System was Financially Unstable from the Start

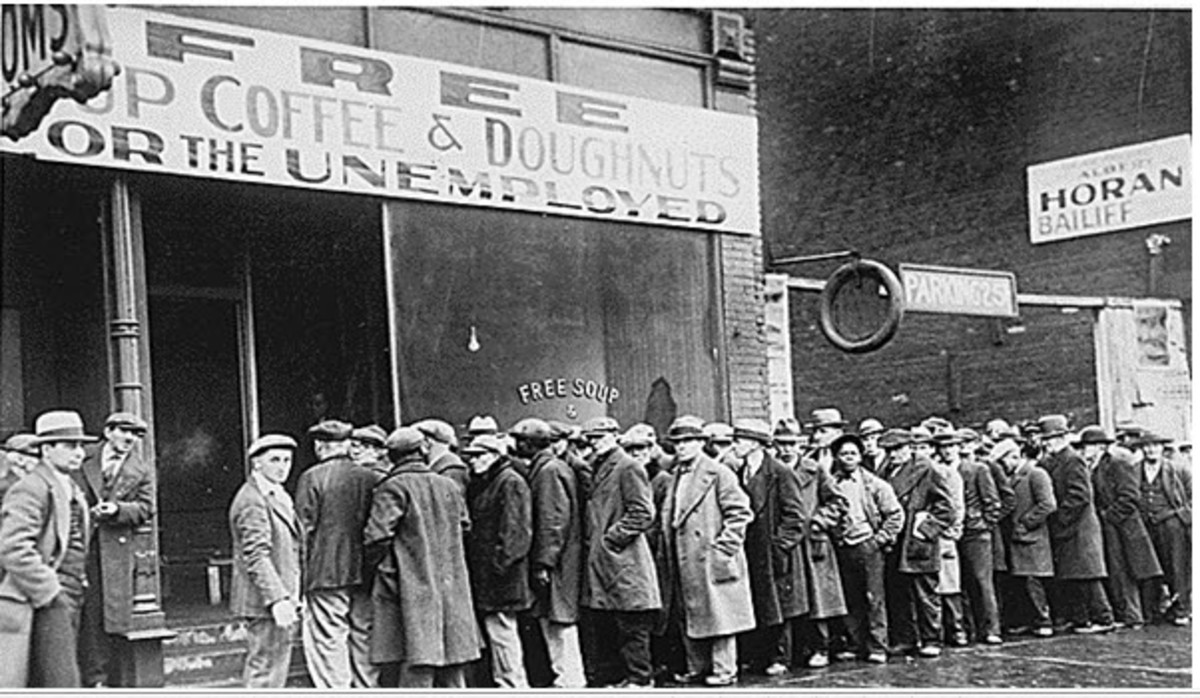

By now most everyone is aware that the Social Security program is not a sound program financially and that it is only a matter of time until it goes broke.

Even its supporters admit that the only way to keep it limping along is through periodic tax increases.

The system is basically a Ponzi scheme in which the tax contributions of current workers pay the retirement benefits of current retirees, as the contributions of current retirees was used to pay the pensions of those who retired before them.

One only has to look at Ida Mae Fuller, the woman who received the first Social Security check issued, for proof of this. Just go to the Social Security Administration's website where Miss Fuller's Social Security tax payments are listed.

Like other working Americans, Miss Fuller, who worked as a legal secretary in Ludlow, Vermont, began paying Social Security taxes when the system started in 1937. In November of 1939 she retired and, upon turning 65 in January 1940, began collecting Social Security.

The sum of Miss Fuller's Social Security tax payments over the nearly three years she paid into the system came to $24.75 and her first Social Security retirement check was for $22.54.

With her first monthly check Miss Fuller got back 91% of what she had contributed, then went on to live to be 100 and, in the process, collected a total of $22,888.92 in Social Security benefits. Even Enron's accountants were not able to devise a scheme that produced returns like this.

Even without the demographic changes which have occurred over the years - the decline in birth rates and advances in medicine which have led to more people surviving to old age and, in old age, people living longer - the system is financially unstable.

In fact this model of paying returns to early participants in the the system with the investments of those coming later, a scheme made famous a decade and a half before Social Security by Charles Ponzi, is so fraudulent that not only was Mr. Ponzi sent to prison for fraud but so has everyone else who has been caught trying to sell these schemes.

The only reason this system has worked so long for the government is because the government has forced most of the working people in the U.S. (with the exception of members of Congress who originally exempted themselves from having to participate) to join the system and, when the system begins to weaken, has forced them to raise their contributions through increases in the tax.

Supreme Court Rulings on status of Social Security

Social Security was originally sold to the American people as a combination of social insurance (the disability and survivors provisions of the law) and a pension scheme.

The government continues to refer to the program as an insurance and pension program and most people continue to believe it to be such.

However, the reality is that the program is really nothing more that a law passed by Congress which provides for a tax on incomes and a welfare system whereby money is transferred from working people to people who are retired, disabled or are young children in families where one of the breadwinners has died.

For proof that the system is not a bonafide insurance or pension program one only has to read the 1937 Supreme Court opinion delivered by Justice Cardozo in the case of Helvering vs Davis in which the Court clearly stated that Social Security was not an insurance or pension plan but was simply a law providing for a tax and a welfare program.

In their opinion the Justices further pointed out that while the law creating Social Security called for the creation of an Old-Age Reserve Account by the Treasury Department, it was up to Congress to allocate funds for the account as it saw fit.

The Old Age Reserve Account was, and still is, nothing more than a place to hold the funds that Congress appropriates each year that are to be paid out that year in benefits. The Court went on to stipulate that Congress was under no legal obligation to allocate the funds collected by the Social Security tax to the account and could spend the funds collected as it saw fit.

Two and a half decades later in the 1960 case of Flemming vs Nestor the Court reversed a lower court ruling and ruled that Congress could, with a simple majority vote, modify, amend or repeal all or part of the law, even going so far as to repeal the welfare provision but keep the tax.

This Supreme Court decision also made very clear that taxpayers who paid into Social Security did not have any contractual right to benefits declaring THE NONCONTRACTUAL INTEREST OF AN EMPLOYEE COVERED BY THE ACT CANNOT BE SOUNDLY ANALOGIZED TO THAT OF THE HOLDER OF AN ANNUITY, WHOSE RIGHTS TO BENEFITS ARE BASED ON HIS CONTRACTUAL PREMIUM PAYMENTS.

In other words, Social Security is not like a 401(k) plan, annuity or other type of private investment plan which the individual owns and has contractual rights to the income and the principal.

High Taxes in Mid-Twentieth Century Forced People to Rely on Social Security

Of course, in the era in which both of these cases were heard there was no question of Congress altering the program to take away people's benefits or using the tax funds collected for other purposes.

Any member of Congress who even dared to raise the the issue of changing Social Security was guaranteed to lose the next election. But the reason for this was that, thanks to very high income taxes (with marginal rates as high as 90%), the vast majority of the population had no choice but to rely on Social Security for their retirement.

Conservatives and libertarians often point out that private property is a cornerstone of freedom in that owning property enables people to support themselves and be independent.

However, when the government confiscates property, as it does through high taxation, people lose their ability to be self-reliant and become dependent upon those who control the property, a concept stressed in Frederic Hayek's famous book The Road to Serfdom.

The urban legend-like story about the brutal communist dictator, Joseph Stalin, and the chicken nicely illustrates the relationship between property and dependency. The story goes like this.

One day while relaxing with associates at his dacha in the former Soviet Republic of Georgia, Stalin was having some difficulty getting his associates to understand the relationship between control and power.

Seeing the chickens running around the courtyard where he was sitting, Stalin decided to demonstrate his theory. Grabbing one of the chickens, he began pulling fistfuls of feathers from the terrified chicken. The chicken struggled and fought back fiercely, but Stalin held it firmly with one hand while he removed the feathers with the other.

To the surprise of Stalin's audience, as soon as all the feathers were removed the chicken stopped struggling and fighting and became very docile, snuggling peacefully into Stalin's hand.

Stalin then explained that without its feathers to keep its body heat inside, the chicken would quickly die of the cold if it stayed in the shade and, lacking any pigmentation to protect its skin from the sun, its skin would be severely burned if it ventured into the sun for warmth.

The chicken, like the millions of people who had had their property taken by the communists, had no choice but to peacefully submit in order to survive.

It is true that people in the era 1930 - 1980 were free to save for their retirement. However, to accumulate the sums needed to support ones self in old age, it is necessary to take advantage of what is known as compounding.

This is the process by which one invests money - either in interest bearing accounts or stocks/mutual funds which pay dividends - and allows the interest/dividend income to be reinvested as additional savings which generate increased interest or dividends in the next cycle.

Unfortunately, interest and dividends are considered income for tax purposes and are subject to the income tax.

Over time the interest and/or dividends steadily increase and not only push the owner into ever higher tax brackets but increasingly force the investor to either pull money from the investment to pay the taxes (thereby reducing the compounding effect) or pay them from current income (thereby severely limiting the person's current spending.

The Seeds of Change are Planted

Despite the fact that people would punish at the polls any politician who threatened to cut their promised Social Security benefits, many did not like the system, especially the Social Security tax which had to be increased periodically to keep the system solvent.

Then three events occurred in the two decades between the mid-1960s and the mid 1980s which laid the basis for undermining the system and weakening the chains the bound citizens to it.

The first was the introduction of IRA (Individual Retirement Accounts) during the Carter Administration. Social Security was in the midst of one of its recurring financial shortfalls and the government realized that they could never raise taxes high enough to provide the comfortable retirement that people were coming to expect.

Therefore, along with the tax hike to fix the immediate problem, the law provided for the creation of Individual Retirement Accounts which people could open and invest up to $2,000 per year (since increased) for retirement.

To encourage people to open these accounts, Congress not only allowed taxpayers to deduct the funds invested each year from gross income for Federal Income Tax purposes (but not for Social Security or Medicare tax purposes) but also allow the income generated by the accounts to grow tax free until they were withdrawn at retirement.

A few years later, during the Reagan Administration, continuing problems with Social Security financing as well as with private pensions, led Congress to again raise taxes for the immediate problem and create a much bigger retirement income savings option, the so called 401(k) accounts.

401(k) accounts allowed employees to contribute a significantly larger amount than the IRA limit AND their employers were given the option of matching, up to 100%, the contribution of the employee in lieu of providing a traditional pension plan.

Like IRAs, contributions were deducted from income for Federal Income Tax purposes and the income generated was allowed to grow tax free.

The third change involved severely restricting an employer's right to insist that employees retire at age 65.

While never a legal requirement, with the introduction of Social Security age 65 became a de facto retirement age which resulted in many people being forced into retirement at age 65. The government also relaxed the penalties on working and collecting Social Security.

It has taken some time for funds invested in IRA and 401(k) accounts to grow but, in the decades since these reforms were initiated, ever increasing numbers of new retirees and workers approaching retirement are finding that they no longer have to rely on Social Security.

Sure, having paid into the system all these years, they would like to collect it, however, since they are no longer financially dependent upon the program for survival they won't fight very hard to defend the system.

Until recently, these people along with younger workers, most of whom are coming to accept the fact that the system will go broke long before they retire, have had an incentive to continue to support the system politically.

These retirees had little choice in that their already retired parents or grandparents, who, because of their age, had little or no opportunity to take advantage of IRA and 401(k) accounts for a long enough time to accumulate sufficient funds to be financially independent, were dependent upon the system for their retirement.

But old age is taking its toll on this group of older retirees and, as they die, the system not only loses their support but the support of their Social Security Taxpaying children and grandchildren.

As time passes, ever growing numbers of people will no longer need to rely on Social Security. Not only will increasing numbers of them not fight to save the system, but many of those still working will push for its demise in order to escape the burden of the Social Security Tax. And tax cuts of any kind are very popular with voters these days.

Adding to the momentum for abolishing the system is the fact that the so called baby boom generation, a big chunk of the population, is giving every indication that many of them have no intention of retiring and ceasing to work for income.

Sure, most will leave their present jobs and begin collecting their pensions and tapping their retirement savings, but these people will also continue working somewhere and often for themselves by starting their own businesses. Not only won't these people need Social Security but will increasingly resent having to continue paying for it.

Social Security is no Longer Immune from Debate or Criticism

Here is where the Supreme Court cases cited above come into play.

Since Social Security is simply a law providing for a special income tax and welfare program, it is directly under the control of Congress. Once a majority of the members of Congress see that they can get more votes for reelection by opposing rather than supporting Social Security, the law could quickly be repealed.

If provision is made to use general revenues to keep the monthly pension checks going to the dwindling pool of retirees still dependent upon the system, that group will have no reason to oppose dismantling the rest of the system.

Even though the government can keep the system financially viable for the next quarter century or more, it could be terminated politically much sooner.

The writing is already on the wall. In 1964 Republican Presidential Candidate Barry Goldwater, in response to a reporter's question, made an off-handed remark that maybe Social Security should be made voluntary.

That single remark all but lost the election for him and was a big factor in Lyndon Johnson's huge landslide that year.

Opposing Social Security Ceases to be an End to a Political Career

For the following two decades, Social Security was known as the third rail of politics promising instant political death to any candidate who so much as hinted at changing its basic structure.

However, in the 2000 election, George Bush suggested that a tiny portion of a person's Social Security Tax contributions be put into a private account in which the funds in it were the property of the individual contributor.

While this generated considerable criticism, it did not prevent George Bush from winning the election.

Not only was George Bush not punished by the voters for suggesting this idea, but exit polls in that election showed that some other Republican candidates in that election actually benefited from urging the privatization of Social Security.

A final result was that Social Security became a debatable item - no longer could critics of the system be simply dismissed as crackpots as supporters of the system found themselves increasingly being forced to come up with arguments to defend the system.

The 2008 Presidential election witnessed four of the then current eight Republican Presidential candidates come out for full or partial privatization of Social Security in a primary campaign debate.

In fact, of the seven in that debate only Senator John McCain came out in favor maintaining the system with yet another tax increase.

Governor Huckabee went so far as to say point blank that not only should younger workers be freed from the system and told to save themselves for their retirement but also proposed that older workers and recent retirees be offered a one time cash settlement to leave the system.

Congressman Ron Paul stated that the government had an obligation to guarantee the pension for retirees already receiving Social Security and for older workers nearing retirement who were planning on Social Security as their main source of income in retirement.

With that stipulation he then indicated that the Social Security law should simply be repealed. Not only was the audience receptive to these proposals but there was no big outcry over these proposals in the days that followed.

In the years leading up to the 2000 election Social Security ceased to be off limits and became a debatable topic with the emphasis on the best way to reform it in order to save it.

In the years since the 2000 election the debate has increasingly focused on how long it can be kept going. Based upon the recent Republican debate discussed above it now appears that the debate is moving toward how and when to abolish the system.