Obama Economic Policies and High Unemployment

Millions Still Out of Work

The United States is currently in the midst of the longest and deepest economic recession since the Great Depression of the 1930s. The just released June 2012 employment report showed the unemployment rate still stuck at 8.2%. That translates into 12.7 million people without jobs.

Almost half of these people, 5.4 million people, have been unemployed for more than two years.

Bad as the above information is, the real situation is worse. The definition of unemployed used by the U.S. Department of Labor’s Bureau of Labor Statistics (BLS) defines a person who is unemployed as someone who is not only out of work but is also actively looking for work.

Even though a person is out of work, if they are not actively trying to find work, they are not considered unemployed for the purpose of compiling government unemployment statistics.

Another 2.5 Million Unemployed Who are Not Included in Unemployed Statistic

In addition to the 12.7 million people officially listed as unemployed there are another 2.5 million people listed as marginally attached to the labor force.

These are people who don’t have a job but are available for employment. However, having become discouraged, they have have stopped actively looking for a job and are thus no longer officially considered to be unemployed.

Combining these two figures we get 15.2 million (that is 15,200,000 unemployed American workers) or 9.8% of the labor force unemployed.

Even this figure underestimates the true picture as there are a few million more people who are no longer being counted in the statistics as either unemployed or marginally employed.

These are young people who have yet to land their first job, returning military who can’t find civilian employment and others who retired early out of necessity or who are relying on working spouses or other employed friends or relatives for support.

There Are Also 8.2 Million People Who are Underemployed

Finally, while ignoring the few million who don’t have jobs but are off the radar as far as employment statistics are concerned, we have, in addition to the 15.2 million Americans available for work but not working, an additional 8.2 million (8,200,000) working part-time involuntarily.

These 8.2 million are people who want to work full time but due to either hours being cut back by their employers or the inability to find full time work are subsisting on part-time work.

A Tragedy for Bothe the Unemployed Individuals as Well as Society as a Whole

This situation is both an individual tragedy for each of these millions of American individuals who are out of work as well as a tragedy for society as well.

Start with taxes. The Federal, state and local governments are all hard pressed for money with which to operate and provide their services. Ignoring for a moment spending by all levels of government, imagine the impact that the addition of 15.2 million taxpayers to the tax rolls would have on the deficits of all levels of government.

In addition to the increased revenues from the taxes paid by these 15.2 million people, there would also be the savings to all levels of government from not having to spend to provide the social services these unemployed currently need.

Plight of Those Forced into Early Retirement

The 15.2 million represent those who are officially counted in the statistics as being unemployed or marginally attached to the labor force.

There are also those who have dropped out of the labor force completely with many of these being older people who, out of financial necessity, had to take early retirement and begin collecting Social Security, pensions and drawing down retirement savings.

Not only have these people had to accept lower monthly lifetime Social Security and pension payments for taking early retirement but, in the case of Social Security, people who begin receiving Social Security benefits between age 62 and full retirement age, will have their monthly benefit reduced by one dollar for every two dollars earned in excess of the annual limit.

For 2012 the wage earnings limit for those receiving Social Security retirement benefits between age 62 and their full retirement age is $14,640.

After full retirement age (which is 66 for most of the boomer generation) earnings from wages no longer reduce one’s monthly Social Security income when their wages exceed the annual limit.

Social Security System In Deficit Six Years Earlier Than Expected

In addition to the harm done to the unemployed by the recession, taxpayers are also harmed.

As a result of so many people being laid off, Social Security and Medicare tax receipts fell.

This, plus the large number of workers age 62 and older who had no choice but to take early retirement and begin collecting Social Security, has resulted in the Social Security program going into deficit in 2010 as monthly payments to retirees exceeded Social Security tax receipts from workers and their employers.

This was six or seven years earlier than the pre-recession projections whose calculations showed this not happening until 2016 or 2017.

The monthly deficit is now being made up with general revenue funds which means that all taxpayers are contributing to Social Security through their income and other Federal Taxes.

Wage earners and their employers are paying twice - once through their Social Security taxes (which are not progressive with the tax, in 2012, being applied to every dollar of a worker’s income up to $110,100) and again with their income taxes.

Additional Strains Put on Private Pensions and Government Pension Guaranty Program

Corporate and Union defined benefit pensions are also affected. As workers retire earlier than expected not only draw against the assets of these plans sooner but the plans themselves lose those extra years when contributions were expected to be made and returns reinvested.

These pensions are already underfunded so this will just put more pressure on them.

Private pensions are insured by the Federal Pension Benefit Guaranty Program which was under financial strain before the recession and will now be under even more strain which will require a taxpayer bailout sooner rather than later.

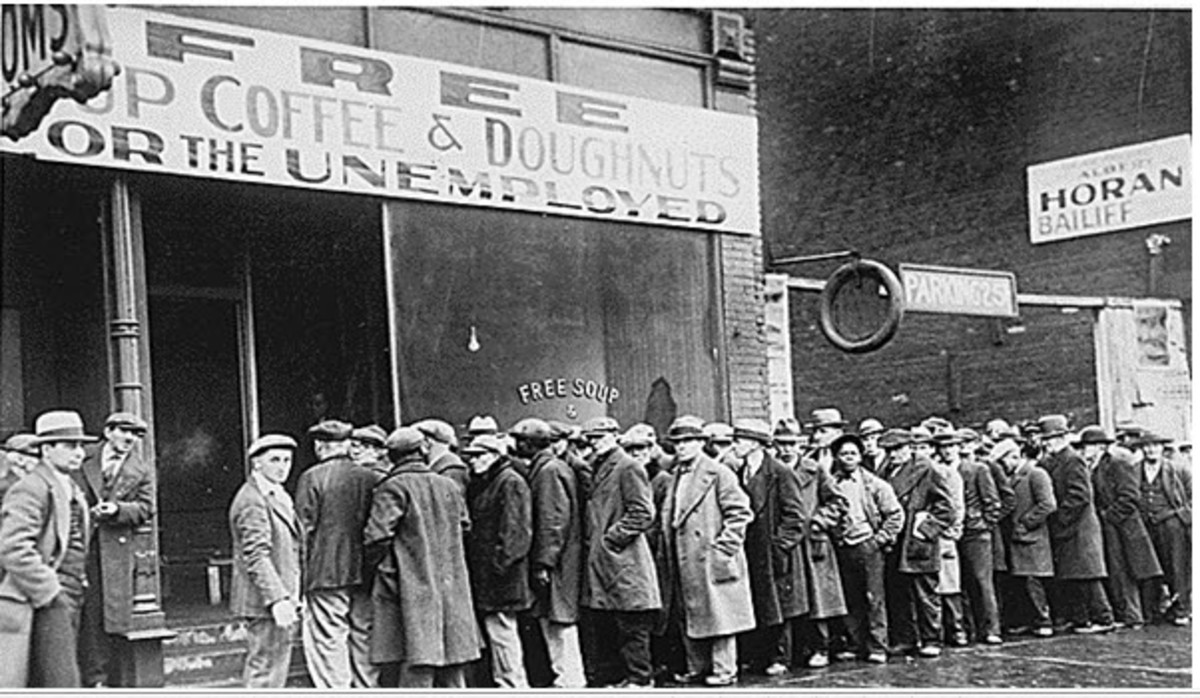

President Obama Has Followed The Same Policies That Prolonged the Great Depression

President Obama has made no secret of the fact that his goal was to move the political center of the United States to the left and he and the Democratic majority in Congress have used this crisis as a means of achieving that goal.

Copying the policies and tactics of Franklin Roosevelt, this Administration has both attempted the same failed policies of the New Deal and, so far, have achieved the same disastrous results.

Instead of an economic downturn followed by a robust recovery as has happened in past recessions since Franklin Roosevelt’s Great Depression, this recession has tended to parallel the Great Depression with a major downturn followed by a weak recovery that stalled with real unemployment stuck in the double digit range.

As a result of the policies pursued by President Roosevelt and his New Deal the economic crash of 1929 was followed by two decades of economic stagnation that didn’t end until his passing and with it the weakening of the appetite of Congress and the American people for his destructive policies.