Improving Your Finances by Refinancing Your Mortgage

The Decision to Refinance Requires Careful Thought

The term mortgage refinance simply means applying for and obtaining a new mortgage loan, not to purchase a home but rather to pay off the present mortgage loan on one's existing property.

Why would someone want to go to the trouble of getting a new loan when they already have a loan? There are a number of reasons that one might want to do this.

First, and probably the most common reason is that interest rates have dropped and the borrower wants a new loan with a lower rate of interest along with the lower monthly payment that goes with the lower interest rate.

Second, and this is somewhat related to the first, if you have had the present mortgage for some time, the remaining balance will have declined and a new thirty-year loan on the lower balance, even at the same interest rate, will have a lower monthly payment than the previous mortgage.

Lowering the mortgage payment will result in increased cash flow (money left over after paying the monthly bills) for the household.

Third, Since interest rates are usually lower on mortgages than they are on unsecured loans like credit cards, it often makes sense to obtain a mortgage for more than the present mortgage and use the extra funds to pay off other, higher interest, unsecured loans. Of course this option only works if the value of the property is greater than the current mortgage balance.

Having a property that is worth substantially more than the current mortgage usually occurs because of one of the following:

- The mortgage was obtained years ago and the monthly payments have reduced the outstanding balance substantially.

- The value of the property has increased due to major improvements.

- Property values have rising making the property more valuable than when it was originally purchased.

Refinancing To Pay off Other Bills Can Result in Lower Monthly Bill Payments

It should be noted that, in today's economic environment, only the first point above is realistic for most people. The second point is possible but, more than likely the owner had to finance the improvements with short term loans and the extra funds in the new mortgage will go to repaying these.

The third point is also not realistic for most people as the 2008 housing market crash has left most property values lower than the original purchase price (often lower than the mortgage balance) rather than higher.

When people find themselves with numerous high interest, unsecured loans and a home with equity in excess of the current mortgage, it advantageous to get a new mortgage in an amount higher than the amount of their current mortgage and use the extra cash to pay off their higher interest unsecured loans and credit card balances.

This not only reduces the amount they pay each month to creditors, it also greatly reduces the amount of interest they are paying on their total debt each month.

Further, in most cases the interest that is paid on the mortgage on one's home can be deducted from their income for federal income tax purposes while interest paid on other loans is not deductible. Thus, consolidating debts with a new mortgage loan will usually not only save on interest but on income taxes as well.

Refinancing is Not Free

While refinancing a mortgage often makes sense, it is not always a wise idea. The main problem with refinancing is the cost of points and other fees.

Points on a mortgage loan refer to interest paid up front. One Point is one percent of the loan amount.

Points are often used to buy down or reduce the interest rate. So, instead of paying say 10% on your mortgage you pay one point up front (1%) and have a 9% rate on the mortgage itself.

Points can also be charged for other things such as the mortgage broker's (the person who brings the borrower and lender together) fee or to cover costs and profit of the mortgage bank (an organization that prepares the documents, originates the loan and then sells it to a bank or insurance company).

Loan Points and the Loan Officer's Commission

Part of the points go to the loan officer who works with the borrower in making the loan.

Most loan officers now days work on commission and their commission comes from points. In fact loan officers usually have some control over the amount of points charged with their employer requiring a minimum of one to two points or more for the company and then whatever else the loan officer can get is kept as his or her commission.

In a highly competitive environment, borrowers can shop and find loan officers, and sometimes mortgage banks themselves, who will reduce points in order to get the business.

It works the other way also as I once spoke with a loan officer at a party who described how he and his fellow loan officers had a special class of points called pita points.

PITA stood for Pain In The Ass and the pita points were an extra one-quarter to one-half percent charged in addition to their regular commission points. PITA points were levied on obnoxious customers who were a pain in the ass during the loan process.

Ironically, these obnoxious borrowers were so busy making a nuisance of themselves over other matters that they failed to notice that they were paying more for their loan!

Points and Fees Can Wipe Out Savings From a Lower Interest Rate

While buyers can pay the points and other fees (appraisal, credit report, termite inspection, deed and mortgage filing fees, etc.) with cash at the time of loan closing, many people accept the lender's offer to include these in the mortgage - which, of course, increases the loan amount and adds to the amount of interest you will pay over the years.

Whether you pay cash or finance the fees by including them as part of the new loan, the fees and points are a cost to consider along with the new rate on the loan.

Generally, the savings in interest on the new loan should be sufficient to allow you to recoup the cost of the fees and points within about a year, otherwise, if it takes much longer, the money paid for fees and points will offset the savings on the lower interest rate.

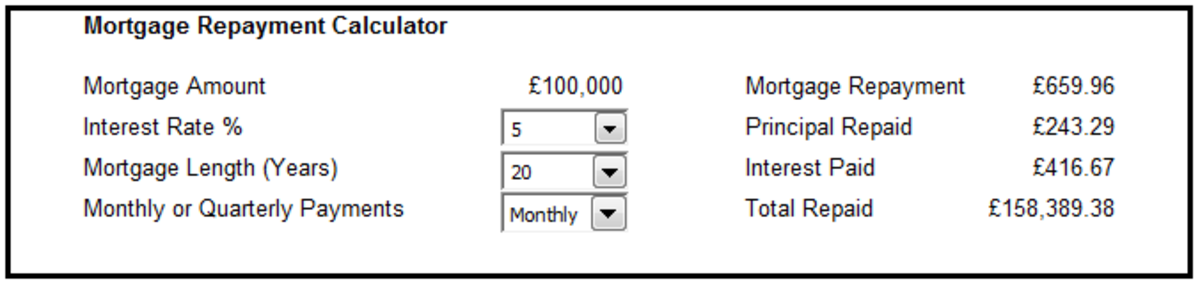

Sites like Bankrate.com, Yahoo Finance, Google Finance and others all have calculators that allow you to calculate how long it will take you to recover the cost of the points and fees paid through the savings in interest.

Refinancing as a Personal Finance Restructuring

Large corporations as well as federal, state and local governments regularly take advantage of lower interest rates or the opportunity to borrow longer term to reduce the cost of debt or to reduce monthly debt payments.

This is called restructuring and it as the advantage of their monthly debt payments making it easier to keep revenues and expenses in balance.

While corporations and governments do this by selling long term bonds and using the money raised to pay off higher interest or higher payment on bonds with a shorter remaining term, an individual can accomplish the same results for their finances by refinancing with a longer term mortgage and using it to pay off a mortgage with a shorter remaining term and other short term bills with higher interest rates.

A longer term mortgage, especially if it has a lower interest rate, used in this way can have the same effect on a household's finances. Namely reducing both the fixed monthly total loan expense and long term savings on interest.

Like a large corporation or government, this results in helping to bring the household's monthly income and expenses into balance or, better still, produce a surplus of monthly income over debt.

Use Refinance of a Mortgage to Improve Household Finances and Not Increase Total Debt

Refinancing for the purpose of restructuring debt or making a major improvement to the property (which increases the value of the home which is an asset) are both good reasons for refinancing one's mortgage.

However, except in extreme circumstances (such as the loss of a job or major illness) it is not a good idea to refinance a mortgage and use the excess cash for current expenses such as a vacation, day to day living expenses, etc. as one ends up spending the borrowed funds on things consumed today while having to pay for them over the next 20 to 30 years.

Like other major life decisions, the decision to refinance or not refinance depends not only upon external factors such as current interest rates but on the household's current financial situation and their assessment of what the future will bring as mortgage loans are generally financial commitments spanning the next fifteen to thirty years.

© 2007 Chuck Nugent