Bush Tax Cuts Benefit Everyone - Not Just the Wealthy

The Arguments for Keeping the Tax Cuts

Those who favor the continuation of the Bush tax cuts argue that these cuts are needed to encourage investment which, in turn, will result in a stronger economy and more job creation.

As I pointed out in my Hub entitled How Tax Cuts Work, this is true to the extent that the cuts are made to the rates in the higher tax brackets of a progressive income tax system (our Federal and State income tax systems are progressive systems) and that the rates are such that they are discouraging work and investment to some extent.

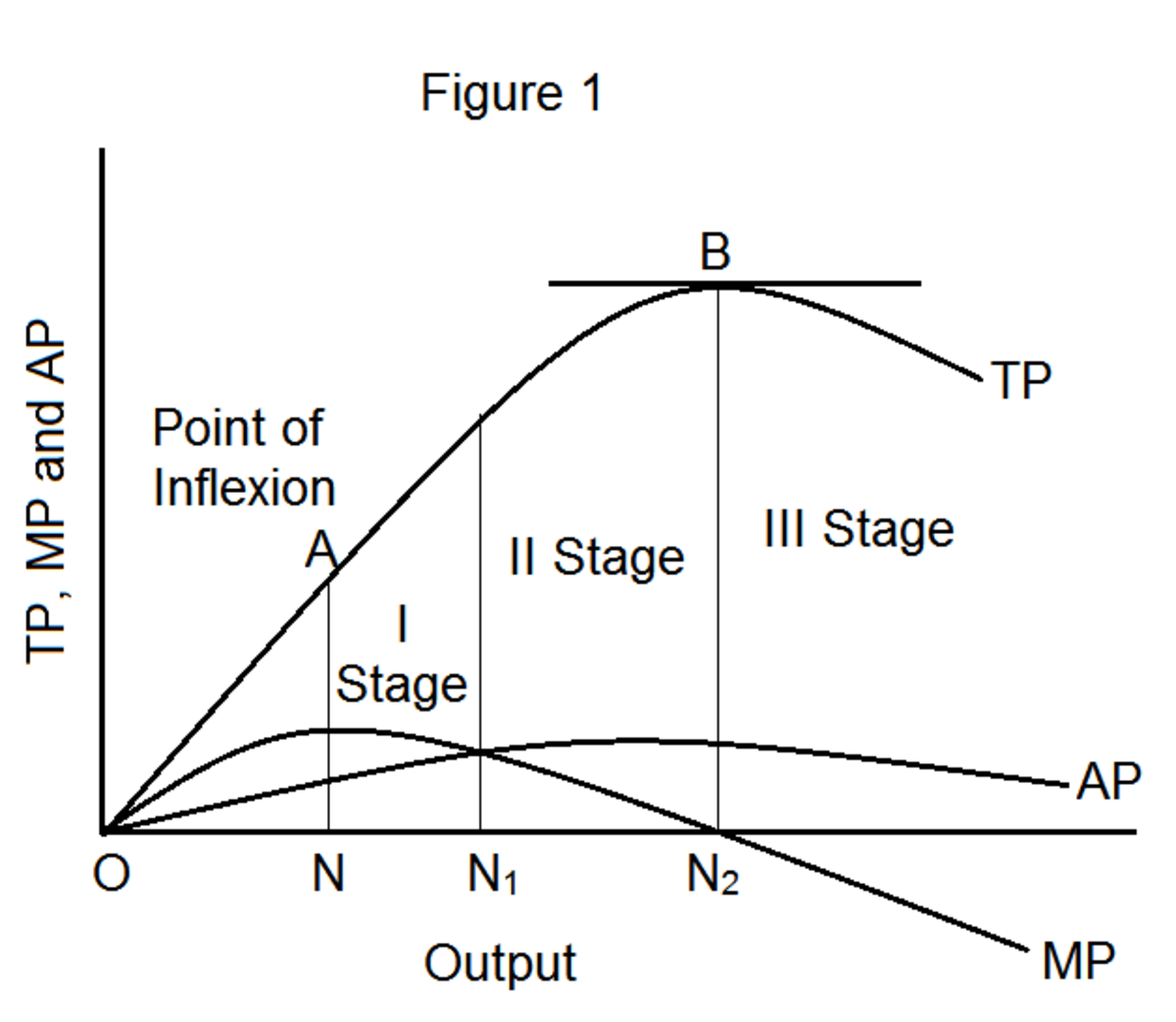

The Laffer Curve

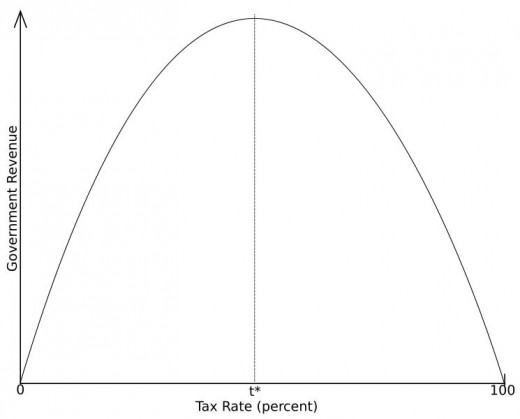

The famous Laffer Curve (named after the economist Arthur Laffer who first publicized it) shows how increasing tax rates result in increased tax revenues up to a point - after this point increasing marginal tax rates (the rates in the higher brackets) result in lower revenues for the government.

You will notice that the only numbers on curve are found on the horizontal axis and these are zero at the starting point of the curve and 100 where the curve intersects the axis on the right side.

Point "t" on the horizontal axis shows the point where the slope of the curve ceases to increase and begins decreasing indicating that, at these points on the curve to the right of the "t", government revenues collected with the tax will be decreasing as the rate increases.

The reasons there are no numbers is that, first, we don't know at exactly what rate the slope of the curve will become negative thereby reflecting reduced tax revenue collection from increased rates.

Second, even if we could determine the point precisely, it is not only subject to change overall but the point also varies from taxpayer to taxpayer.

The key question then is at what marginal rate(s) will the increased rate(s) result in less rather than more Federal tax revenues collected?

During a national crisis, like World War II, people are more willing to sacrifice for the good of the nation. However, in the absence people perceiving a real threat to the nation's well being the point at which the slope of the Laffer Curve turns downward will be considerably to the left of the World War II point.

Evidence of Tax Cut Success

While we cannot pinpoint the rate at which taxes cause work and investment to decline, there are plenty of anecdotal examples of this occurring.

The 1978 Steiger Capital Gains Tax Cut legislation (named after Representative Bill Steiger of Wisconsin) reduced the tax rate on the gains resulting from the sale of capital assets.

This resulted in many people suddenly selling stocks and other assets whose price had increased noticeably since the purchase of the asset. Much of this increase had been due to the government's continued inflating of the money supply rather than any real gain in value.

Many of the assets sold following the Steiger Tax Cut were associated with the old industrial economy which was not growing. The money gained from the sales was then reinvested in the new high tech economy allowing that sector to grow and increase jobs.

Bush Era Tax Cuts Have Increased, Not Decreased, Tax Revenue

Former President Ronald Reagan used to tell the story of his experiences as an actor in the high tax era of the 1950s.

He found that his income from being the lead actor in five feature film productions each year left his family with a comfortable income.

However, if he made a sixth movie the additional income earned from that movie would push him into a higher tax bracket (which was in the 90% range in those days) which, after paying the higher tax on that portion of his income, left him and his family with very little additional income for that year.

The 90% tax on his income earned by making more than five movies per year was the same as having his pay for additional movies cut by 90%.

Faced with the choice of spending time home relaxing with his family or working on location for a few weeks for 10% of his normal pay, he choose to limit himself to five films. This, of course meant that many of the other workers on the set whose jobs and income were tied to Reagan's movies were also limited to five films per year.

Since these other workers were in lower tax brackets, they suffered a noticeable cut in their incomes due to less work.

My Hub entitled Rolling Stones Prove Tax Cuts Work contains numerous other examples of entertainers and other high income people choosing to live and work abroad, thereby reducing work opportunities in their home countries for others who would normally be hired as support workers, in an effort to avoid burdensome high taxes.

Keeping the tax cuts in place will help keep America competitive in the global market by encouraging more investment which will result in more jobs and greater output by the economy.

More people working and earning incomes result in an increase in total income. The larger the total national income the greater the amount of revenue raised by existing tax rates.

Reductions in Top Marginal Tax Rates Do Benefit the Rich

The tax cuts do favor those with higher incomes. But this is because, under our progressive income tax system, the only people who pay the high marginal rates are those with the highest incomes.

The term marginal here refers to the tax bracket in which the last dollars of income are taxed. Our Federal Income Tax is a progressive tax in which the tax rate increases as one's income increases. Under a progressive tax system, income is divided into brackets with the rate increasing on each successively higher bracket.

High income people do not pay a higher rate than others on their total income. Instead the higher rates are only on the higher brackets of their income.

The progressive nature of our tax system is such that, as one's income rises, the additional increments of income are taxed at progressively higher rates. Since the incomes of lower income people are below the threshold at which the higher rates kick in, they are not being penalized by the tax cuts.

If the high tax rates in the upper income brackets actually generate significant tax revenues for the government and the cutting of these rates results in a reduction in total tax revenues there would be no reason for cutting marginal rates.

Such a reduction would be bad policy for two reasons.

First, assuming the citizens as a whole were benefiting from the current level of government spending, the resulting reduction in tax revenue would leave the nation as a whole worse off.

Second, if the only way to restore the lost revenue was to increase the tax burden on lower income people this would be unfair, to say the least.

However, this is not the case as history has shown that reducing high marginal rates encourages higher income people to work and invest more thereby creating a larger income pool on which to levy the tax.

For example, if the total income available to tax in the 90% bracket is one billion dollars ($1,000,000,000) then the government will collect nine hundred million dollars ($900,000,000) in taxes on incomes in this bracket.

Tax Cuts and Government Revenue

The income tax cuts enacted during the administrations of Calvin Coolidge in the 1920s, Kennedy-Johnson in the 1960s, Ronald Reagan in the 1980s and the administration of George Bush have all resulted in total tax revenues increasing.

This is because, with the tax cuts, there was not only more income produced to tax in the top brackets, but the fact that additional jobs were created for people in the lower tax brackets. The new jobs created resulted in an increase in the number of workers in these lower brackets thereby increasing the total amount of income available to tax in all brackets.

However, politicians are addicted to spending and, in each of the recent tax cuts, Congress has gone on a spending binge every time the revenues from tax cuts increased.

By assuming that continued increases in spending are both inevitable and necessary, left leaning politicians and their allies in the media are able to correctly assume growing deficits as projected spending is outpacing current tax revenues.

Their mistake is their assumption that they can take the current income of wealthy people, raise the tax rates on the highest brackets and multiply the current income of wealthy people by the new rate.

Assuming that the new marginal tax rates on the wealthy are high enough AND that wealthy people will continue to earn as much income as under present rates, this will generate the revenue needed to cover the anticipated spending increases.

The problem here is that by increasing the marginal tax rates, wealthy people will reduce their income by working less thereby avoiding the higher tax rates. This will often result in tax revenues falling rather than rising leading to large deficits.

If we cut the top rate from 90% to 50% and, due to higher income people deciding to work and invest more (such as former President Reagan deciding to make six or seven films per year rather the five), income available for taxation in the now 50% bracket increases to two billion dollars ($2,000,000,000).

At the new, lower, 50% top marginal tax rate the government's tax revenue from this group rises to one billion dollars ($1,000,000,000) or one hundred million ($100,000,000) more than at the previous 90% rate.

Since the tax cut resulted in the government collecting more revenue from the high income brackets than previously, there is no need to raise more money from lower income people by increasing the taxes in the lower brackets.

Further, the tax cut only applies to rates in the top brackets which only affect the last dollars of income earned by high income people, leaving high income people to continue to pay the same rates as everyone else on income taxed in the lower brackets.

This situation is no different than if the government had enacted a fifty cent per cup tax on tea sold by the cup over the counter but had no tax on coffee sold by the cup.

If the government then reduced the tea tax to twenty-five cents it would clearly be a tax cut favoring tea drinkers but one would be hard put to argue that coffee drinkers had been slighted or harmed by this in any way.

The Real Issue Here Is Freedom vs Bureaucratic Dictate

As I have pointed out in comments in my previous Hubs dealing with tax cuts, there is another, less articulated, reason why some on the left oppose tax cuts.

Both the late economist John Kenneth Galbraith and, more recently Paul Krugman, have opposed tax cuts on the grounds that spending decisions in the economy should be made by government rather than by individuals.

Galbraith, even though he was a member of the Kennedy Administration, opposed the Kennedy-Johnson tax cuts on the grounds that people would get used to taxes being cut and would demand more cuts.

Galbraith was not so much concerned with the government's revenue needs as he was with the idea that the government, rather than individuals, should make the decisions as to how much and what types of products people should consume.

In some of his writings (such as the Affluent Society), Galbraith actually called for the establishment of a special system of schools to attract and train people for careers in government.

These specially trained career bureaucrats would be responsible for micro-management of the economy. Their duties were to be making decisions as to what products would be produced for people.

Galbraith envisioned these bureaucrats deciding on things like the types of books, movies and other entertainment to be produced for people to enjoy in their leisure time. Of course these bureaucrats, not the individual consumers, would decide what would be available in these areas.

Galbraith envisioned taxing away most of people's discretionary income and using it to produce goods selected for them by elitist bureaucrats - meaning that things like Monday Night Football would be replaced with entertainment like Masterpiece Theater.

Books like Aldous Huxley's Brave New World and George Orwell's Animal Farm offer a glimpse into the regimented society ruled by bureaucratic fiat that elitists like Galbraith envisioned and wished to see created.

In the final analysis the tax cut debate is really about individual freedom of choice vs bureaucratic dictate.

- Democrat vs Republican Tax Cuts

My Hub on the differences between Keynesian style tax cuts (favored by Democrats) and Supply Side Tax Cuts (favored by Republicans) - THE SUPPLY-SIDE REVOLUTION

An article by former Wall Street Journal Editor Robert Bartley and Amity Shlaes