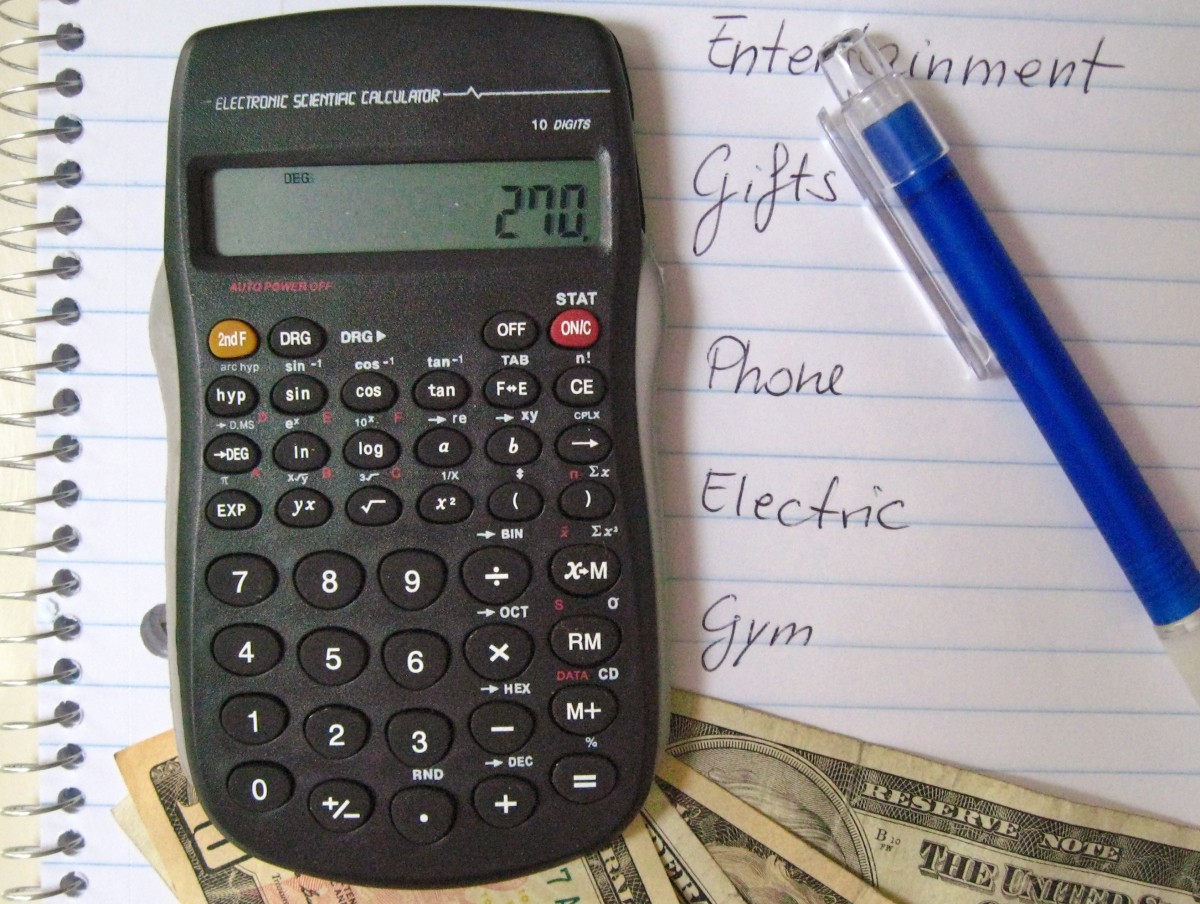

Small Steps to Make Saving Money Less Painful

Starting a Savings Habit

When it comes to savings most people end up saving whatever is left over at the end of the month.

This is the opposite of what almost all financial advisers advise, which is that people should follow a pay yourself first system by taking a predetermined amount from each paycheck and putting it into savings before proceeding to pay bills and other things.

While the pay yourself first habit is great advice, it is usually a very difficult habit to start especially when one is living from paycheck to paycheck.

The easiest way to start a pay yourself first system is when your disposable income increases.

Easiest Way to Start Savings is When Disposable Income Increases

Things like pay raises, a new income source such as a spouse going to work or engaging in additional part-time income opportunities , such as HubPages, are some examples of income increasing and providing an opportunity to start saving money.

Reducing or eliminating certain bills or fixed monthly expenses are another opportunity to start a pay yourself plan as, while you income has not increased, your expenses have decreased which, like an increase in income, leave you with more money to spend.

As everyone who has ever had a pay raise or paid off a large monthly bill has experienced, the new found wealth is quickly absorbed by new spending which again leaves nothing for savings.

In order to painlessly begin a pay yourself first savings plan is to immediately, upon receiving the raise or paying off the bill, instituting a system to set a portion of the new increased cash flow into savings.

In the discussion below, I explain how the temporary 2% reduction in Social Security taxes could have been used to start a savings plan. While the reduction in Social Security taxes being taken from their paychecks was small for most people, little amounts when stashed away can add up over time.

In the case of the Social Security tax cut, it was temporary meaning that it was scheduled to return to the original rate a year later (at the end of 2011 it was extended by 1 more year which delayed the return to the original rate until 2013) so the boost in income was temporary.

While the Social Security tax reduction only lasted two years the idea of diverting all or part of increases in spendable income (extra spending money resulting from an increase in income or reduction in expenses) is a painless way to save for the future.

2% Social Security Tax Cut Meant More Money in People's 2011 & 2012Paychecks

Beginning in the year 2011, every worker in the United States received a 2% reduction in their Social Security taxes. This put new money into paychecks as, previously 6.2% of each person’s income was grabbed by the IRS before their paycheck was written.

During the years 2011 and 2012, the IRS took only 4.2% of each person’s earnings before the person was paid, thereby leaving 2% more money for the worker who earned it.

As a result of this 2% reduction, employees who took a close look at the detail that accompanied their paychecks noticed that the deduction for Social Security on their first paycheck in January 2011 was a few dollars less than was deducted on their last paycheck in December 2010.

This, of course, assumed that the gross pay (pay before any taxes and other deductions) on both checks was the same (overtime, commissions, bonuses, etc. can result in gross pay varying between checks).

The Social Security tax can appear under different headings on a person’s pay stub. The most common designations are:

Social Security or Soc Sec

Social Security and Medicare

FICA (Federal Insurance Contributions Act - the law authorizing the tax)

FICA & Medicare

OASDI (Old Age, Survivors and Disability Insurance - the Social Security program)

Even Small Savings Add up Over Time

Unless the gross pay and other deductions on one's January and December pay stubs were the same except for the Social Security, the easiest way to determine the savings was to simply multiply their gross pay by 2% to see how much one would have gained by this Social Security tax reduction.

Depending upon one's current wage, the tax savings generally varied from $5 or less to double digit figures for most people. While not much on each paycheck, over the course of the entire year the 2% savings on each week’s gross pay often added up to a few hundred dollars.

For example, someone working 40 hours per week and earning the then current Federal minimum wage of $7.25 per hour the gross weekly pay was $290 and two percent of this came to $5.80 ($7.25 times 40 hours = $290 gross pay and 2% of this equals $5.80).

However, $5.80 per week times 52 weeks comes to $301.60.

Because the increase in after tax income on most people’s paychecks in 2011 was small, it probably went unnoticed and, the fact that most didn't notice it could have been used as a painless way to start a savings plan.

Below are some suggestions for places this barely noticeable increase in income from the 2% Social Security tax decrease could have been put to work for one's financial health:

Open an IRA (Individual Retirement Account) Account

For those workers who hadn't started saving for retirement, January 2011 was a good time to start. The extra money from the Social Security tax reduction would have been an easy and painless way to start.

By opening a traditional IRA a person receives an additional tax savings as money deposited in a traditional IRA can be deducted from income for Federal Income tax purposes thereby allowing one to leverage the 2011 Social Security tax cut into a reduction in their 2011 Federal Income taxes due.

Another option is to open a Roth IRA. Putting money into a Roth IRA does not result in a reduction in income for Federal Income tax purposes but it will grow tax free (as the traditional IRA will also do) and when a person begins to withdraw the money at retirement he or she will not have to pay Federal Income taxes on that retirement income.

Open A Holiday Account at Your Bank or Credit Union

Holiday accounts originally started out a Christmas Club accounts into which people could deposit small amounts weekly or monthly to accumulate over a year and then have the balance sent to them at Christmas for shopping.

The names have changed and many offer annual payouts at times other than Christmas but principle is the same, namely a way to put money aside regularly in a separate account over 12 months for a specific goal.

This type of savings plan allows a person tot make periodic weekly or monthly payments to themselves at no cost so they can pay cash for Christmas, vacations or other annual expenses up front.

This is simply the reverse of the way many people now pay for Christmas shopping or vacations which is to charge the expense and then make regular monthly payments, plus finance charges, to their credit card companies AFTER the purchase.

The savings on future credit card finance charges from a system like this could be many times the 2% Social Security Tax reduction.

Invest in a Dividend Reinvestment Plan (DRIP).

So called DRIPs are plans offered by various investment companies which allow a person to not only reinvest stock dividends in fractional shares of that stock but, in many cases, also allow one to also purchase additional whole or fractional shares through regular monthly purchases.

The regular monthly purchases are usually a fixed amount drawn automatically from your checking or savings account.

Fees vary but there is strong competition in this area which is forcing fees down. This can be a good way to start investing for the long term. But be sure to do your research on fees charged first and select a program that puts most of your savings into your investment and not the investment company’s pocket..

Make Extra Payments on Your Bills

This is the area where one can easily get the most bang for their buck.

While all of the suggestions above are great for savings, understand that even though there are many savings plans that don’t involve fees, the return on regular bank savings accounts is usually less than one percent.

Even quality stock investments usually yield 5% or less (while it is true that double or even triple digit returns can be made in certain investments these not only come with a high degree of risk but also require large dollar investments and we are talking about a few dollars per paycheck here).

However, take a look at the interest rate on your mortgage, car loan, credit card or other loans and more than likely these will be in excess of 5% and often double digit percents.

Adding the few dollars saved from the Social Security Tax reduction to the monthly payment on a mortgage, car, credit card or other loan is almost the same as putting it into a savings account and receiving an annual interest rate equal to the rate on your loan.

I say almost the same since, unlike most savings accounts, you cannot withdraw these funds in the future (however, in the case of a credit card you could use the extra credit available from paying down the principal to charge more in the future).

As I have explained in my Hubs on Bi-Weekly Mortgage loans Amortized Loans making extra payments to principal on a loan has the effect of reducing the original balance of the loan. You have a smaller loan but you scheduled monthly payments remain the same.

The result is that you not only reduce the amount of the loan by the extra payment you also save all of the interest you would have paid between now and the payoff date on the extra payment.

Depending upon the remaining length of the loan and the interest rate this savings can be as much as two or more times the extra amount you added to your payment.

Social Security Tax Reduction No Longer Exists but Other Opportunities are All Around

As I said at the beginning, the small reduction in the Social Security tax ended at the end of 2012 making it no longer available as a savings source.

However, small and painless opportunities for savings are all around us. Here are some ideas:

- When you empty your pockets at night throw change into a jar and when it gets full take it to a bank or credit union and deposit it into a savings account

- If you have the opportunity to refinance your mortgage at a lower interest rate ask to have your payment remain at the current level and have them apply the difference between the new and old payment toward principal reduction. This will reduce the total interest you will pay as well as result in your loan being paid off early.

- Sign up for bi-weekly mortgage payments with half the monthly payment taken out of each paycheck - this is painless and will result in paying your loan off faster

- Round up fixed payments on loans to the next $5 or $10 - this is a small amount but will reduce the amount of interest paid as well as accelerate the payoff of the loan.

- Sign up for the 401(k) retirement plan at work. Money will be deducted from each paycheck but after a few paychecks you won't notice it and over time the money your contribute, matches by your employer and investment income will grow into a sizable amount over time.

© 2011 Chuck Nugent